Donald Trump’s tax plan is still a bit of mystery. For instance, it might include a roughly $1.5 trillion tax cut that would benefit wealthy business owners like himself. Or it might not! His campaign has sent mixed signals, and four days after rolling out the proposal during a big event in New York, that trifling detail still isn’t clear.

But you know what is transparent at this point? That Trump’s tax package—including its much-hyped child care plan—is basically worthless to the middle class. The thing is a multitrillion-dollar gift to the rich.

That’s one very obvious takeaway from a new analysis released Monday morning by the conservative Tax Foundation. In order to deal with the ambiguity hanging over Trump’s proposal, the think tank ran two sets of calculations. One included the tax cut that Trump’s campaign has waffled on—a controversial break for so-called pass-through businesses—and one did not. Either way, the picture is pretty much the same for middle-class households. They get very little, while upper-income Americans reap a windfall.

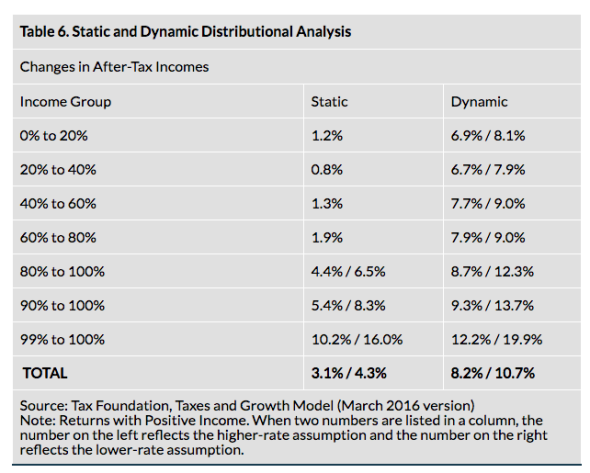

Here’s the Tax Foundation’s breakdown showing how much families at each rung of the income ladder would see their after-tax income increase if Trump got his way. You want to pay attention to the “static” analysis on the left, which sticks to the effect of tax cuts on their own. The dynamic analysis on the right factors in the impact of all the economic growth the Tax Foundation thinks Trump’s cuts would spur—which, to put it lightly, is extremely hypothetical. Under the static analysis, the bottom 80 percent of families would generally see their income rise by less than 2 percent (taxpayers in the 20th to 40th percentile would get less than a 1 percent increase, on average). Top 1 percenters, meanwhile, get a 10.2 percent average boost without the pass-through tax cut, and 16 percent increase with it.

Now keep this in mind: The foundation tells me its analysis incorporates all of Trump’s child care plan, which operates through the tax code using a combination of credits, deductions, and tax-exempt savings accounts. In many states, center-based child care can cost up to 10 to 15 percent of a typical family’s income, according to Childcare Aware. The sum total of Trump’s tax and child care benefits don’t come close to touching that for the families who need it. In fact, they’re so small as to be practically negligible.

This is all in the context of a tax plan that will cost between $4.4 trillion to $5.9 trillion, according to the Tax Foundation’s estimates. We are talking about trickle-down economics at its extreme. In the true style of a man who loves Las Vegas, Trump has made his offer to the middle class, and it is this: nothing.