Aside from a being a testament to the White House’s willingness to decimate large swaths of the social safety net, it appears Donald Trump’s new budget is based on a transparent and nonsensical accounting gimmick.

Here’s the deal. The administration says its new proposal will erase the budget deficit after 10 years. However, to get there, it assumes that its policies—basically, tax cuts and deregulation—will send economic growth surging to 3 percent per year, allowing the government to collect $2 trillion or so in tax revenue. This is fanciful. You might as well write that eliminating the estate tax will cause an avenging nuclear lizard to rise from the sea and vanquish ISIS. But this kind of magical thinking about tax cuts is more or less standard these days.

It’s the next step in the administration’s arithmetic that seemingly qualifies as a straightforward fraud (or a hilarious error, depending on how you interpret intent here). The budget mentions the tax cuts, but doesn’t include any of their costs. Instead, it just states that they’ll be deficit-neutral, presumably thanks largely to their economic benefits (Treasury Secretary Steve Mnuchin has insisted that the administration’s tax reductions would cover their own cost through growth). In other words, the White House is relying on its tax cuts to both pay for themselves and then add $2 trillion to the government’s coffers. It’s essentially double-counting their (already dubious) benefits.

“This is a mistake no serious business person would make,” economist and former Treasury Secretary Larry Summers wrote Monday. “It appears to be the most egregious accounting error in a presidential budget in the nearly 40 years I have been tracking them.”

To be fair, there are other potential interpretations of the administration’s calculations. One is that it believes the tax cuts will, in fact, be so salubrious for the economy that they’ll more than pay for themselves. This would be almost as intellectually bankrupt as simple double-counting, but would at least inoculate the White House from accusations of mathematical incompetence.

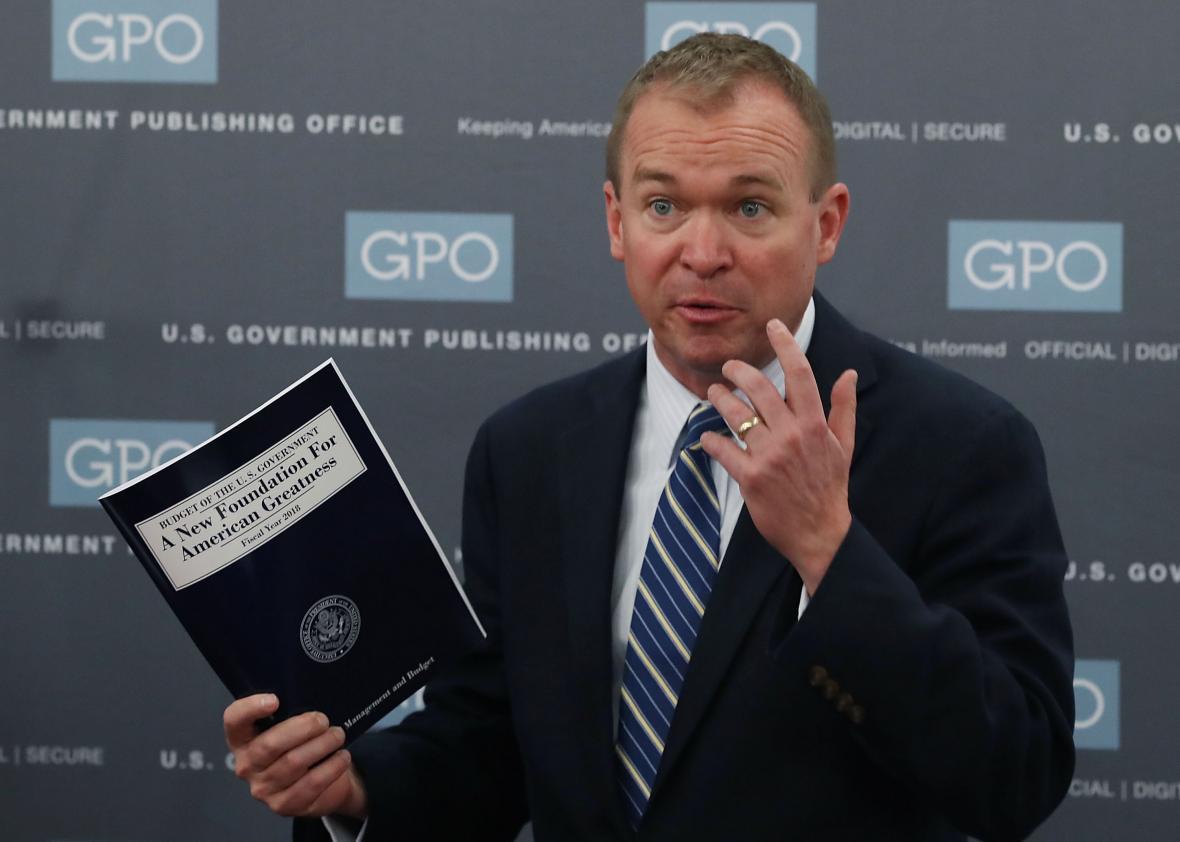

It could also simply be that the administration hasn’t fleshed out its tax plan enough to spell out how it would influence the deficit. According to the Wall Street Journal, Office of Management and Budget Mick Mulvaney told reporters on Monday that the cuts mentioned in the budget are just a “placeholder” with details TBD.

“It was in all honesty the most efficient way to look at it, because if we said it’s going to add to the deficit, then we have to go into more detail than what’s in the summary right now,” Mulvaney said. “If we say it’s going to reduce the deficit, we have to go into more detail than what’s in it right now. And we simply are not in a position to do that.”

Or, maybe—just maybe—this proposal isn’t really meant to be an economically coherent policy document, and is instead merely a flashing signal to Congressional Republicans that they should feel free to eviscerate the government’s social spending programs once they get around to formulating their own budget. You don’t have to be any good at math to tell Paul Ryan to sharpen his knives.