Tough break, New Jersey.

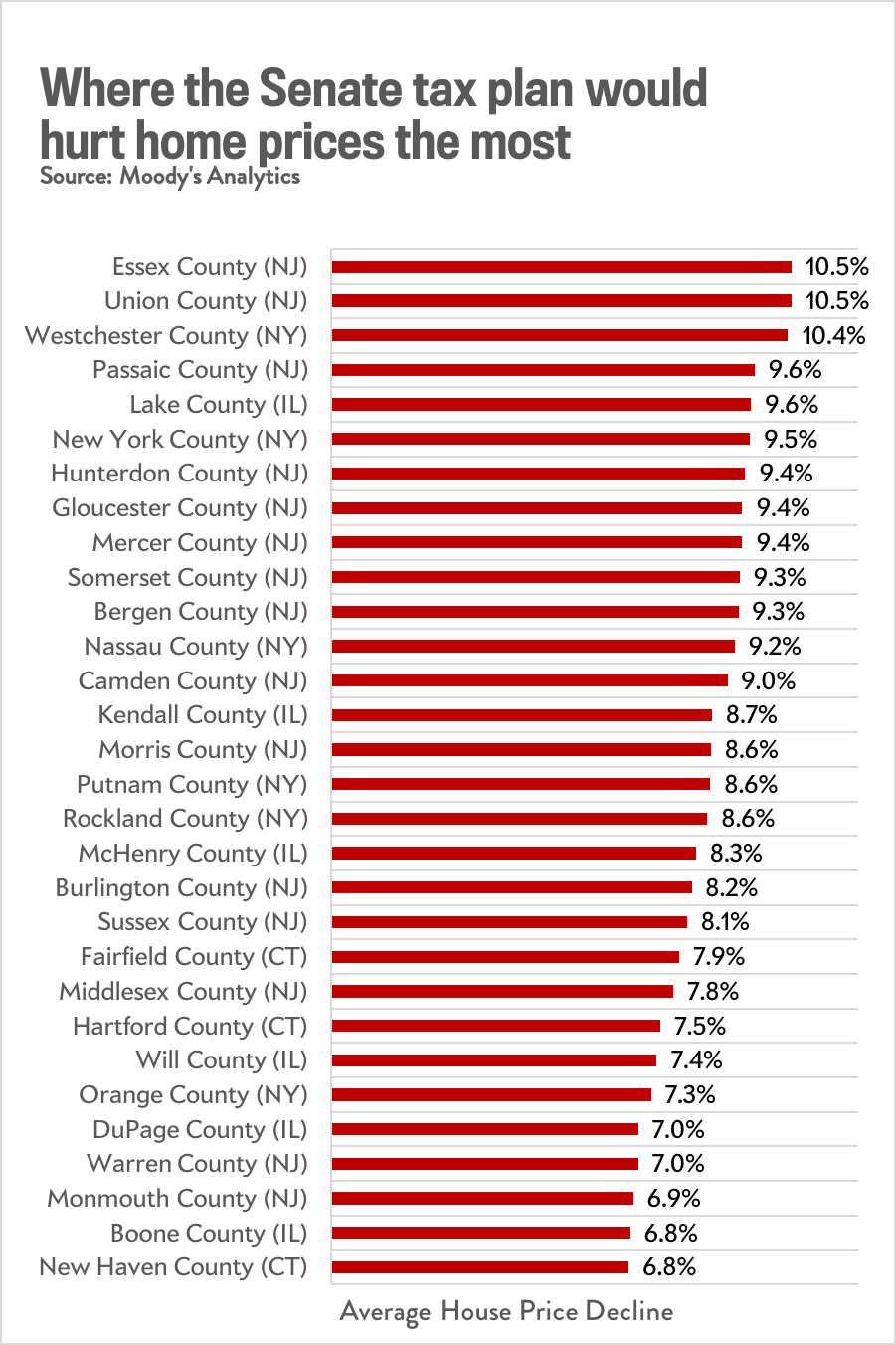

Because they’re designed to cap popular deductions that benefit homeowners and limit the number of itemizers, the Republican tax bills are expected to put a dent in house prices around much of the United States. And, under the recently passed Senate version, nowhere seems to get it worse than the Garden State. According to modeling by Moody’s Analytics, 15 of the country’s 30 hardest hit counties would be in New Jersey. Homes in the lovely bedroom communities of Essex County, just over the river from Manhattan, would suffer the country’s biggest setback, losing more than a tenth of their value.

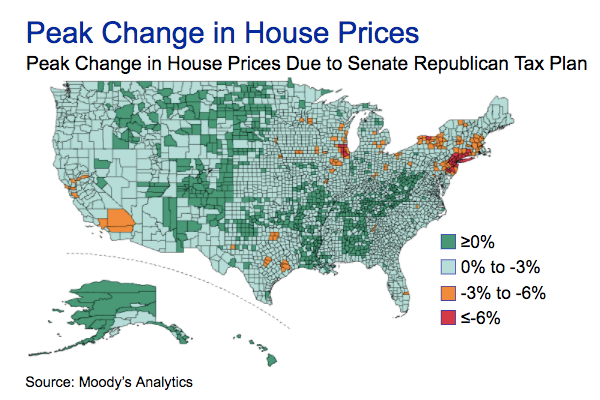

Nationally, the Senate bill would shave approximately 3 percent off home prices in 2019, Moody’s chief economist Mark Zandi told me. But the impact would be uneven—with the pain concentrated most in parts of the Northeast, California, and the Chicago area (which are, of course, largely Democratic strongholds). Even within metro areas, residents could see some big variation: In New York City, for instance, Manhattan would see a 9.5 percent drop in home values. In Queens and Brooklyn, the decline would be less than 2 percent.

There are a few of reasons why the Republican tax plans would deflate real estate prices. For starters, both would double the standard deduction that most Americans claim on their returns each year, which would drastically reduce the number of families who bother to itemize. That would render the tax benefits of owning a home, such as the mortgage interest deduction, useless for much of the country, weighing on real estate prices. The House and Senate bills also cap the property tax deduction at $10,000, which is high—except by the standards of the New York Metropolitan area. In New Jersey, about 30 percent of homeowners pay more than that on their property tax bill; in the Empire State, about a fifth do. The limit on property tax deductions is the biggest driver of price declines in Moody’s model.

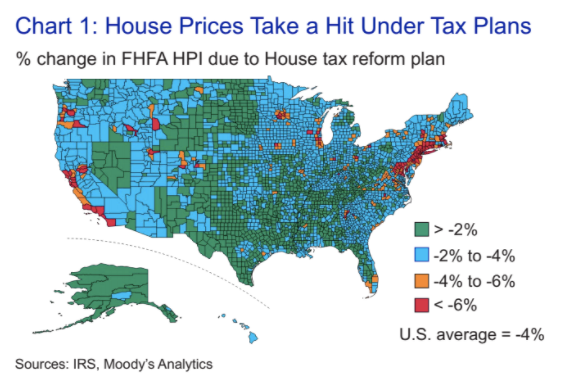

Finally, the House bill goes a step further by further limiting the mortgage interest deduction for new buyers. Today, borrowers can claim breaks on up to $1 million of debt. That would fall to $500,000.

Even if you take special schadenfreude in the pain of comfortable, coastal homeowners, a 3 percent loss in housing prices nationwide is not exactly something to celebrate, given that home equity is the single most important source of savings for much of the middle class. But there are also reasons not to get overly hysterical.

First, this is just one forecast. I’ve talked to a few housing economists, and there’s currently a lot of uncertainty about how badly the tax reforms Republicans have lined up will hurt home values. A recent federal reserve board paper suggested that killing the mortgage interest deduction entirely would result in an almost 7 percent decline in home values nationwide. But Richard Green, who chairs the University of Southern California’s Lusk Center for Real Estate, told me that thanks to changes in the housing market, there are reasons to think that curtailing the tax incentives for homeownership wouldn’t deal as big a blow to prices as it would have in the past. “Could it have a mildly depressive impact on housing? Sure. Would it be catastrophic? No.”

Second, Moody’s isn’t predicting that home prices will fall from where they are today. Rather, they’ll just be lower than if the tax bill didn’t pass. “In some of these markets you’ll see price declines,” Zandi told me. “But in most you’ll see a year or 18 months of flat prices,” instead of the rising values homeowners have come to expect. Some of the declines are also temporary. Moody’s expects the effect to peak in 2019, then begin to fade as the market adjusts. These aren’t the kind of impacts you’d expect to lead to a housing-triggered recession. “It’s not existential. It’s an adjustment,” Zandi said.

Finally, some parts of the country might actually see home prices go up a smidge, since tax cuts could put more money in people’s pockets—though the bump doesn’t exceed 1.1 percent anywhere.

All of which brings up a question: If Republicans are going to raid Americans’ home equity to finance tax cuts for corporations and rich business owners no matter what, why not go whole hog like the House and cut the mortgage interest deduction down to size? According to Moody’s analysis, that would only lead to a slightly larger average drop in home prices—4 percent, instead of 3 percent.

The biggest victims would seemingly be in California, where property taxes are relatively low and many itemizers rely more heavily on claiming their mortgage interest. There are going to be losers in this tax plan, and better it be homeowners in Santa Barbara than, say, broke grad students.